The Four balance sheet problem first appeared in the report titled ‘India’s Great Slowdown’: Subramanian, former Chief Economic Adviser to the Government of India.

The Four balance sheet problem first appeared in the report titled ‘India’s Great Slowdown’: Subramanian, former Chief Economic Adviser to the Government of India.

Context

- The GDP numbers are worrying enough, but the disaggregated data are even more distressing as the Production of consumer and investment goods is falling.

- The GDP numbers are worrying enough, but the disaggregated data are even more distressing as the Production of consumer and investment goods is falling.

State of the Indian economy

- India's long-term growth has slowed as the 3 engines propelling rapid growth – investment, exports and consumption.

- Declining Investments

- The RBI, which tracks capital expenditure (CAPEX plans of the private corporate sector finds that both the 'animal spirits' and the 'business sentiments' are missing since 2010-11.

- In the RBI report says the year 2017-18 "marked the seventh successive annual contraction in the private corporate sector's CAPEX plans".

- Plummeting exports

- As per the softening of commodity prices including crude, the US-China trade war, Brexit and developments in Iran, Turkey and other Gulf nations further aggravated the problem of the world economy.

- India’s exports contracted 6.57% in September as shipments of petroleum, engineering, gems & jewellery and chemicals.

- Stagnant Consumption

- According to CSO, private consumption expenditure decelerated to an 18-quarter low of 3.1% in the June quarter.

- Rise of the ride-sharing economy and a mindset reset among younger consumers are taking a toll on automobile sales.

- Low rural wages and high food prices have further harmed the consumption.

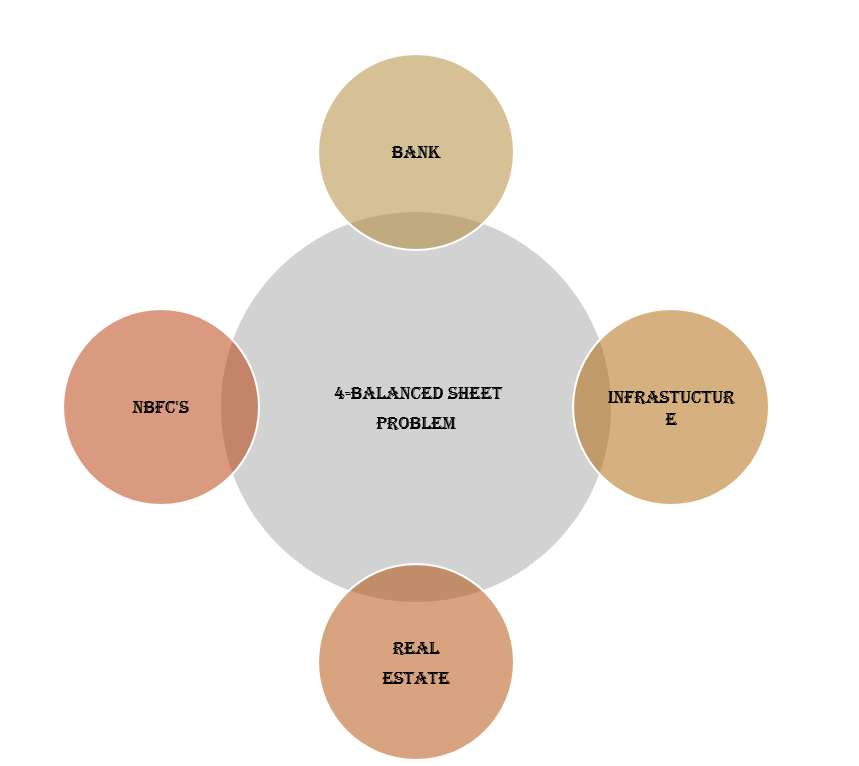

About the problem of Four balance sheet problem causing great Indian Slowdown

- The Great Slowdown stems from a balance sheet crisis that arrived in two waves

- The first wave :

- The Twin Balance Sheet crisis: encompassing banks and infrastructure companies

- The problem began after the global financial crisis when the world economy slowed down.

- The second wave

- The collapse of a credit boom, led by NBFCs, and the real estate sector.

- The collapse owed to the recognition that the boom involved unsustainable financing of a rising inventory of unsold housing.

- As a result, the economy now confronts a Four Balance Sheet (FBS) problem.

- India's long-term growth has slowed as the 3 engines propelling rapid growth – investment, exports and consumption.

- Declining Investments

- The RBI, which tracks capital expenditure (CAPEX plans of the private corporate sector finds that both the 'animal spirits' and the 'business sentiments' are missing since 2010-11.

- In the RBI report says the year 2017-18 "marked the seventh successive annual contraction in the private corporate sector's CAPEX plans".

- Plummeting exports

- As per the softening of commodity prices including crude, the US-China trade war, Brexit and developments in Iran, Turkey and other Gulf nations further aggravated the problem of the world economy.

- India’s exports contracted 6.57% in September as shipments of petroleum, engineering, gems & jewellery and chemicals.

- Stagnant Consumption

- According to CSO, private consumption expenditure decelerated to an 18-quarter low of 3.1% in the June quarter.

- Rise of the ride-sharing economy and a mindset reset among younger consumers are taking a toll on automobile sales.

- Low rural wages and high food prices have further harmed the consumption.

About the problem of Four balance sheet problem causing great Indian Slowdown

- The Great Slowdown stems from a balance sheet crisis that arrived in two waves

- The first wave :

- The Twin Balance Sheet crisis: encompassing banks and infrastructure companies

- The problem began after the global financial crisis when the world economy slowed down.

- The second wave

- The collapse of a credit boom, led by NBFCs, and the real estate sector.

- The collapse owed to the recognition that the boom involved unsustainable financing of a rising inventory of unsold housing.

- As a result, the economy now confronts a Four Balance Sheet (FBS) problem.

Challenges before the government to solve the 4-balance sheet problem

- Limitation of the RBI’s monetary policy

- Monetary policy is stymied by a broken transmission mechanism, which impedes the pass-through of cuts in policy rates to lending rates.

- No Scope for Fiscal stimulus

- The fiscal deficit is already high.

- larger bond issues will only further crowd out the private sector, by pushing up already-high interest rates.

- Strengthened IBC cannot solve the crisis in power-sector and real estate.

- Power Sector -Unlike most assets, private power firms cannot be easily sold,

- They are incurring heavy operational losses.

- But neither can they be liquidated.

- In real estate, the IBC will provide only partial compensation to the prospective owners and delayed justice .

- Non-possibility of the private sector-led solution:

- The viability of power assets is inextricably entwined with government policies.

- For example, demand for power depends on whether the state electricity boards are financially strong enough to buy the power that the public is demanding.

- Limitation of the RBI’s monetary policy

- Monetary policy is stymied by a broken transmission mechanism, which impedes the pass-through of cuts in policy rates to lending rates.

- No Scope for Fiscal stimulus

- The fiscal deficit is already high.

- larger bond issues will only further crowd out the private sector, by pushing up already-high interest rates.

- Strengthened IBC cannot solve the crisis in power-sector and real estate.

- Power Sector -Unlike most assets, private power firms cannot be easily sold,

- They are incurring heavy operational losses.

- But neither can they be liquidated.

- In real estate, the IBC will provide only partial compensation to the prospective owners and delayed justice .

- Non-possibility of the private sector-led solution:

- The viability of power assets is inextricably entwined with government policies.

- For example, demand for power depends on whether the state electricity boards are financially strong enough to buy the power that the public is demanding.

India witnessing cooperative federalism failure as state finances strangulates

About the issue

- Kerala government reportedly stuck to its stance of maintaining the dual rate structure.

- It goes against the idea and spirit of cooperative federalism.

- More states are to follow suit.

- Kerala government reportedly stuck to its stance of maintaining the dual rate structure.

- It goes against the idea and spirit of cooperative federalism.

- More states are to follow suit.

Reason for such a move

- Centre delaying compensation to states for their revenue loss.

- Under the Goods and Services Tax (Compensation to States) Act, states have to be compensated if their revenue growth falls below 14 per cent each year over the 2015-16 base year.

- The shortfall in Compensation cess: Amount being collected through the compensation cess will not be enough to compensate for the shortfall in collections this year.

- Reduction in tax devolution to states.

- Tax devolution to states will also be lower this year as the Centre’s revenues will fall short of its budgeted target.

- Lower revenues for states will force them to cut back on capital spending, further intensifying the slowdown.

- Centre delaying compensation to states for their revenue loss.

- Under the Goods and Services Tax (Compensation to States) Act, states have to be compensated if their revenue growth falls below 14 per cent each year over the 2015-16 base year.

- The shortfall in Compensation cess: Amount being collected through the compensation cess will not be enough to compensate for the shortfall in collections this year.

- Reduction in tax devolution to states.

- Tax devolution to states will also be lower this year as the Centre’s revenues will fall short of its budgeted target.

- Lower revenues for states will force them to cut back on capital spending, further intensifying the slowdown.

Demands of the states

- States are likely to press for extending the compensation period by a few years.

- Raising tax rates to shore up collections.

- State governments have asked for relaxing the fiscal deficit limit to 4 per cent.

- States are likely to press for extending the compensation period by a few years.

- Raising tax rates to shore up collections.

- State governments have asked for relaxing the fiscal deficit limit to 4 per cent.

Way-forward

- Rate rationalization:

- As in some sectors, inputs are taxed at higher rates as compared to final products

- Raising taxes when the economy is slowing down would have been counterproductive.

- Review of GST architecture: the need for the comprehensive review of the GST architecture, in line with the issues flagged by the CAG.

- Rate rationalization:

- As in some sectors, inputs are taxed at higher rates as compared to final products

- Raising taxes when the economy is slowing down would have been counterproductive.

- Review of GST architecture: the need for the comprehensive review of the GST architecture, in line with the issues flagged by the CAG.

Wayforward

As per the recommendation of the

- Recognition of a problem: A new asset quality review to get a more honest recognition of the magnitude of stressed assets, and further strengthening the IBC.

- Special resolution mechanisms for two sectors: Real estate and power.

- For eg-In, the power sector the loans, exceeding Rs 2.5 trillion, of the books of the banks, for that would free up balance sheets and management attention,

- Allowing banks to focus again on their core business of supporting economic growth.

- Establishment of a holding company

- Holding company would operate like a public-sector asset rehabilitation agency-a “bad bank.

- The holding company would buy power companies at prices based on the recommendations of independent parties, such as investment banks,

- The special regulatory regime established by the government would establish for these assets would overlook the independent parties

- Such an open, ruled-based procedure would allow the transaction to be seen as fair by all stakeholders: The holding company, banks, and perhaps most importantly, the public.

- In addition, fair prices would give the holding company a chance to make a profit in the long run as power demand increases.

- 5-year clause: this objective should state that the purpose of the holding company is to sell off the assets within five years, after which it would be dissolved.

- Reducing uncertainties: Especially by securing long-term contractual arrangements for coal inputs to be supplied by Coal India and output to be purchased by state electricity boards. Once this is done, and as demand for electricity grows to the point where the plants can operate at somewhere close to full capacity, the appetite for these assets will gradually revive, at which point they could be sold.

- Reselling of assets to the private sector:

- The ultimate objective would be to sell the plants back to the private sector.

- Eventually, the gap will close between the supply and demand once the capacity utilization increases.

- The asset will be profitable and they can be sold.

- Government exiting the power sector: The Centre and states, should phase out the older environmentally inefficient public sector plants

The bad banks are not magical solutions. They will take some time to establish, and will require difficult political choices, in particular about how to allocate the costs amongst creditors, promoters, homeowners, and taxpayers. The Great Slowdown is upon us. Two bad banks to resolve the Four Balance Sheet problem might be one critical element of the solution.

- Recognition of a problem: A new asset quality review to get a more honest recognition of the magnitude of stressed assets, and further strengthening the IBC.

- Special resolution mechanisms for two sectors: Real estate and power.

- For eg-In, the power sector the loans, exceeding Rs 2.5 trillion, of the books of the banks, for that would free up balance sheets and management attention,

- Allowing banks to focus again on their core business of supporting economic growth.

- Establishment of a holding company

- Holding company would operate like a public-sector asset rehabilitation agency-a “bad bank.

- The holding company would buy power companies at prices based on the recommendations of independent parties, such as investment banks,

- The special regulatory regime established by the government would establish for these assets would overlook the independent parties

- Such an open, ruled-based procedure would allow the transaction to be seen as fair by all stakeholders: The holding company, banks, and perhaps most importantly, the public.

- In addition, fair prices would give the holding company a chance to make a profit in the long run as power demand increases.

- 5-year clause: this objective should state that the purpose of the holding company is to sell off the assets within five years, after which it would be dissolved.

- Reducing uncertainties: Especially by securing long-term contractual arrangements for coal inputs to be supplied by Coal India and output to be purchased by state electricity boards. Once this is done, and as demand for electricity grows to the point where the plants can operate at somewhere close to full capacity, the appetite for these assets will gradually revive, at which point they could be sold.

- Reselling of assets to the private sector:

- The ultimate objective would be to sell the plants back to the private sector.

- Eventually, the gap will close between the supply and demand once the capacity utilization increases.

- The asset will be profitable and they can be sold.

- Government exiting the power sector: The Centre and states, should phase out the older environmentally inefficient public sector plants

The bad banks are not magical solutions. They will take some time to establish, and will require difficult political choices, in particular about how to allocate the costs amongst creditors, promoters, homeowners, and taxpayers. The Great Slowdown is upon us. Two bad banks to resolve the Four Balance Sheet problem might be one critical element of the solution.

No comments:

Post a Comment